Kova Labs

Founders: Touko Rautiainen, Luukas Lohilahti, Teemu Rautavalta, Otso Lehtovuori

We are a sector agnostic early-stage (pre-seed and seed) investor that wants to partner with founders from the very beginning of their journey and support them throughout their growth. Our team has global experience in building and scaling companies both as founders and in various CxO roles.

Ever raised $31M+ in Series A funding, led by Eclipse. The round was joined by Lifeline Ventures, Ibex Investors, Maki.vc, Joint Effects, JIMCO, Failup Ventures, Illusian and others.

Ever is building an AI-native, full-stack model to modernize this infrastructure and to eliminate the complexities of legacy auto retail, starting with electric vehicles.

Read moreEver is building AI-native auto retail, unlocking superior scalability in the $1T+ US auto market. Ever’s purpose-built operations, AI-native operating system, and online-first offering deliver unparalleled customer experience and solve for the complexity that burdens legacy auto retail.

CEO: Lasse Nyberg

Founders: Lasse Nyberg, TJ Casner, Maximilian Quertermous

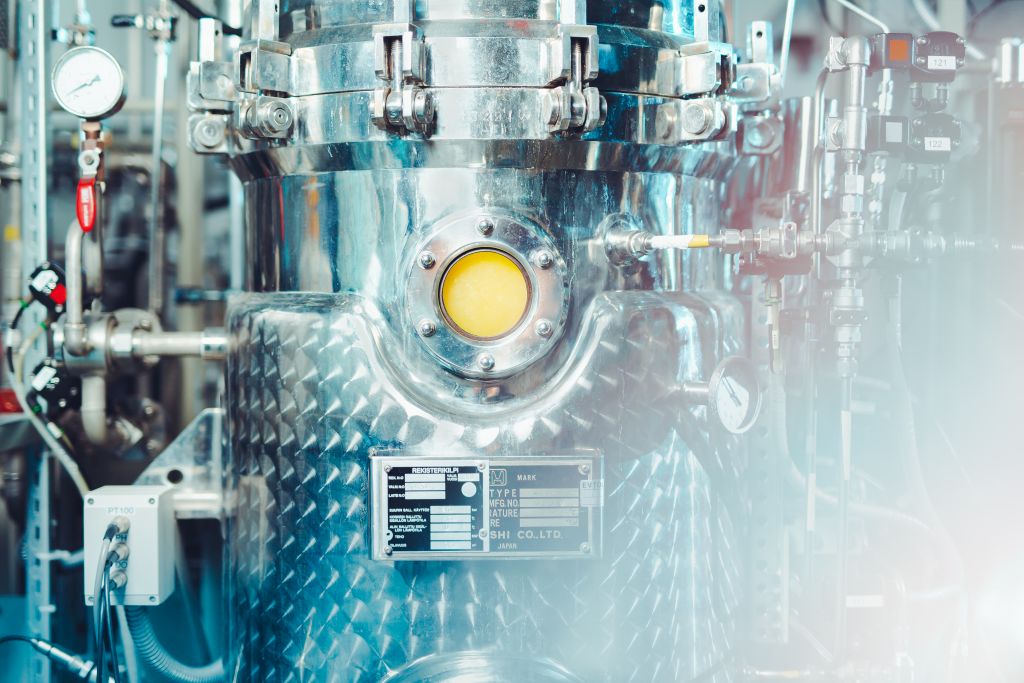

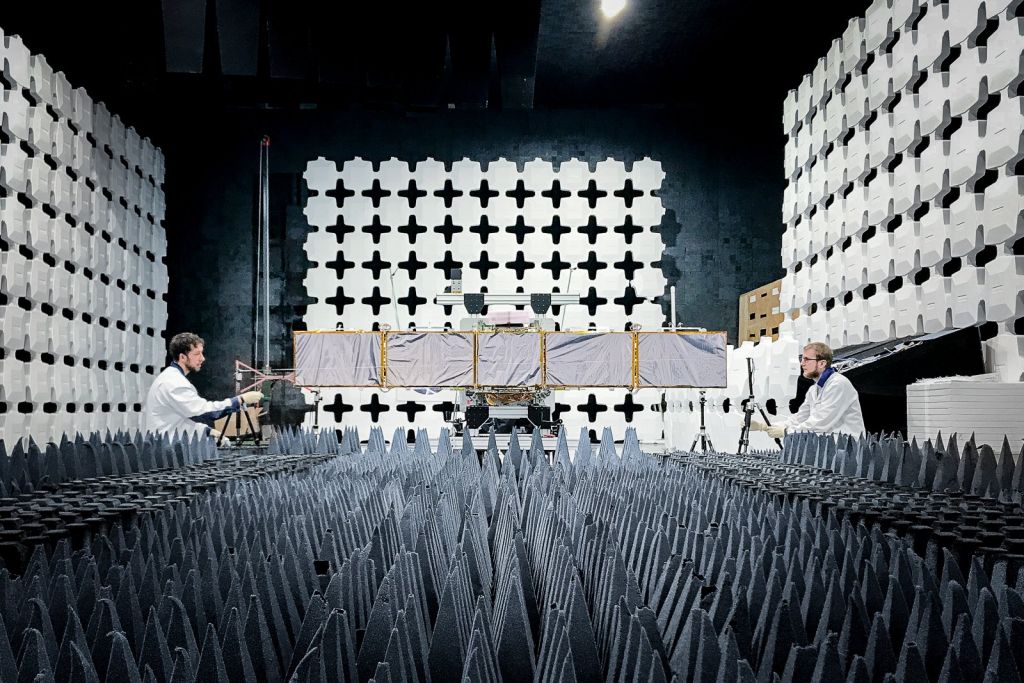

ICEYE has secured EUR 150 million in new funding, as well as a EUR 50 million secondary placement, valuing the company at EUR 2.4 billion (USD 2.8 billion). The Series E round was led by General Catalyst, with strong pan-European participation, including A.P. Moller Holding in Denmark, Bpifrance in France, Vinci (BGK Group) and RiO Family Office from Poland, as well as Finnish investors Solidium, Ilmarinen, European Tech Collective, Keva, Lifeline Ventures, Tesi, Varma Mutual Pension Insurance Company, and Peter Sarlin.

Read moreIceye empowers others to make better decisions in governmental and commercial industries by providing access to timely and reliable satellite imagery. Iceye is the first organization in the world to successfully launch synthetic-aperture radar (SAR) satellites with a launch mass under 100 kg.

CEO: Rafal Modrzewski

Founders: Pekka Laurila, Rafal Modrzewski

Inven raised $12.75M to Fix Deal Sourcing and Company Research in Private Markets.

Read moreInven is an AI powered platform that enables analyzing companies and markets with ease and efficiency. By using AI to identify relevant companies and data points, the Inven platform can supercharge deal sourcing, market analysis, and multiple other workflows for M&A related professionals.

Founders: Niilo Pirttijärvi, Tommi Kupiainen, Ekku Jokinen

Oura, the world’s leading smart ring, announced the completion of a $200 million Series D funding round.

Read moreOura is an award-winning wellness ring and app, designed to help people get more restful sleep and perform better. The independently validated science behind Oura and the design of the Oura ring make it the perfect companion for busy professionals, athletes and anyone who wants to get insights into their sleep, recovery and readiness to perform.

CEO: Tom Hale

Founders: Petteri Lahtela, Kari Kivelä, Markku Koskela, Virpi Tuomivaara, Ashley Colley